|

|

|

In This Update:

DiSanto Proposes Constitutional Amendment to Eliminate School Property TaxesI have introduced a proposal that would allow Pennsylvania residents to vote directly on the elimination of school property taxes through an amendment to the state constitution. Constituents in my district and across the entire Commonwealth are suffering greatly under the weight of constantly increasing school property taxes. The status quo is unacceptable, and voter approval of this constitutional amendment would force the General Assembly to address this issue once and for all. Powerful and entrenched special interests opposing reform would no longer be able to block needed action. For decades, relief measures such as school property tax referendums and casino gaming have fallen short of expectations and have done little to ease the burden of Pennsylvania homeowners—especially our seniors living on fixed-incomes. As recently as 2017, Pennsylvania voters overwhelmingly approved a constitutional amendment expanding the homestead exclusion to 100 percent of a home’s assessed value, yet three more years have passed with no meaningful property tax reforms. I continue to advocate for and support the bipartisan Property Tax Independence Act, introduced as Senate Bill 76, but it has been nearly five years since this measure was last considered on the floor of the Senate, when it was defeated by just one vote. The Governor has expressed his opposition. It’s past time to allow the people of Pennsylvania directly to decide the future of school property tax elimination. Much like the Property Tax Independence Act, this constitutional amendment would have the General Assembly replace school property tax revenues with a combination of state and local sales and income taxes. My proposal would guarantee that our local school districts receive the same amount of revenue as they did from the property tax, so education funding would be more equitable for taxpayers while ensuring school needs are met. DiSanto Introduces Resolution Calling for Congressional Term LimitsThis week I announced the introduction of a concurrent resolution calling for a Convention of States under Article V of the United States Constitution to enact term limits for members of Congress. It complements existing legislative proposals that would establish term limits for members of the state General Assembly. I am a career private sector businessman turned citizen legislator who has personally limited himself to just two terms in office. Elected office is a calling to serve our fellow citizens, not a career predicated upon individual advancement or reelection. Despite many answering the call with good intentions, we have seen how careerism and self-preservation in the insular halls of power in our nation’s Capital leads to the service of entrenched special interests rather than one’s constituents. Term limits serve as a reality check for elected officials as they must return to the real world and live under the laws they pass. Term limits provide fresh perspectives and ideas through increased turnover and help maintain critical and independent judgment over issues without members becoming beholden to lobbyists and executive agencies. I view this issue as another important government reform measure. I have always sought to lead by example–I donate the automatic-cost-of-living increase to charitable causes, have turned down the taxpayer-funded pension, and support legislation to ban cash gifts and per diems for lawmakers. I authored Act 1 of 2019 to forfeit the pensions of elected officials and public employees that abuse their positions of power to commit felonies. State Assistance for Area Cultural OrganizationsThis week state assistance was awarded to several museums and cultural organizations in the 15th Senatorial District impacted by COVID-19 shutdown orders. The COVID-19 Cultural and Museum Preservation Grant Program was created this year to provide grants to cultural organizations and museums that lost revenue due to Governor Wolf’s order to close businesses and other operations deemed non-essential. The program was part of Act 24 of 2020, which distributed approximately $2.1 billion of Pennsylvania’s share of funding from the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act to help many individuals and organizations impacted by the pandemic, including farmers, schools, community-based services, college students, hospitals, long-term care services, child care services, food banks and more. The following area organizations were awarded a COVID-19 Cultural and Museum Preservation Grant:

The funding was awarded by the Commonwealth Finance Authority, an independent agency of the Department of Community and Economic Development. Fifty-two applications were approved across the state. Approved grants range from $5,000 to $25,000 for planning projects and $5,000 to $100,000 for construction projects. All applicants are required to provide a 50% cash match in order to show a commitment from the sponsoring organization. Federal Court Rules Wolf Business Shutdowns, Other Restrictions Unconstitutional

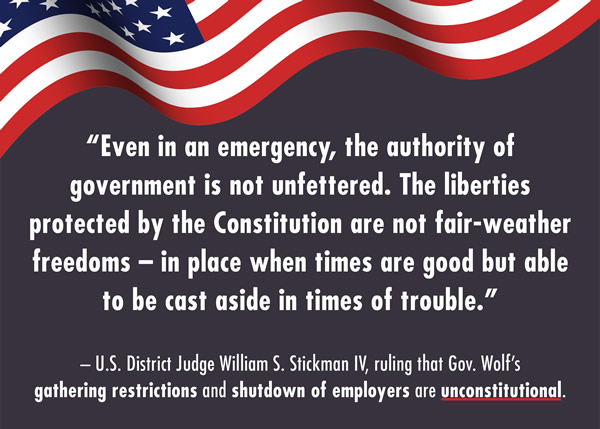

For months, many lawmakers have stressed the need to strike the proper balance between ensuring the health and safety of Pennsylvanians during the COVID-19 pandemic and protecting the freedoms we are guaranteed in the Constitution. A federal judge agreed this week, ruling that some of the actions taken by the Wolf Administration during the pandemic were unconstitutional. In his decision, U.S. District Judge William S. Stickman IV said, “Even in an emergency, the authority of government is not unfettered. The liberties protected by the Constitution are not fair-weather freedoms — in place when times are good but able to be cast aside in times of trouble.” Senate leaders are encouraging Governor Wolf to work cooperatively with lawmakers on a COVID-19 mitigation and recovery plan that puts Pennsylvanians first. The ruling applies to Governor Wolf’s mandated business shutdowns, as well as his restrictions on large gatherings. The Wolf Administration has announced that they will request a stay of the ruling and will appeal the decision. I will provide an update on what this ruling means for all of us as soon as more information is available. Workshop Discussion Focuses on Impact of COVID-19 on Nonprofits, Veterans Groups

Governor Wolf’s COVID-19 business shutdown orders created difficult financial circumstances for many nonprofit groups, including many organizations serving veterans. In many cases, the shutdown order prevented these groups from assisting Pennsylvanians at a time when their needs were greatest. A workshop discussion hosted by the Senate Majority Policy Committee this week explored how these organizations are navigating the pandemic and what challenges remain to be addressed. PennDOT Resumes REAL ID Processing

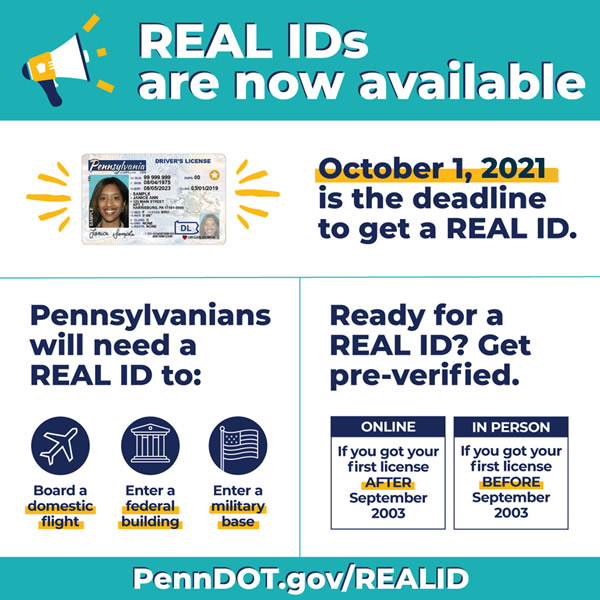

The Pennsylvania Department of Transportation has resumed issuing REAL IDs at reopened Driver License Centers throughout the state. REAL ID processing was suspended in March when most PennDOT offices closed amid the COVID-19 pandemic. The deadline to comply with REAL ID requirements was pushed back one year due to the pandemic. REAL ID is optional for drivers, but driver licenses and photo ID cards will no longer be accepted as a valid form of identification for boarding commercial flights or visiting federal buildings beginning on October 1, 2021. More information about REAL ID is available on PennDOT’s website. Funding Available for Transportation Improvement ProjectsTransportation improvement projects throughout the state could receive a boost from grants through the Multimodal Transportation Fund. The program provides funding for ports and rail freight, increases aviation investments, establishes dedicated funding for bicycle and pedestrian improvements, and allows targeted funding for all modes of transportation. The program is open to municipalities, councils of governments, business/non-profit organizations, economic development organizations, public transportation agencies, public airports, airport authorities, and ports and rail entities. Applications for grants will be accepted through November 6. Senate Committee Explores Challenges Facing Rural Pharmacies

Many rural pharmacies faced severe financial challenges even before the COVID-19 pandemic due to low reimbursement rates from pharmacy benefit managers and bureaucratic red tape. This week, the Senate Majority Policy Committee hosted a workshop discussion to learn more about the challenges facing these businesses to ensure they remain an important part of the health system in rural communities. Testifiers encouraged lawmakers to consider measures to provide greater pricing transparency of prescription drugs and greater oversight of prescription benefit managers. Grants Available to Train Direct Care Workers

The COVID-19 pandemic has had a severe impact on patients and employees in long-term care settings. Grants are available through the Department of Labor and Industry to provide new career opportunities for direct care workers and improve the quality of care provided to patients. The Direct Care Worker Training Grants program helps create and develop training programs that increase the quality of services, offer specialty certifications, and create viable career opportunities for personal care assistants, home health aides and certified nursing assistants. The deadline to apply is October 2. |

|

|

|

2024 © Senate of Pennsylvania | https://www.senatordisanto.com | Privacy Policy |